The coronavirus epidemic has so ravaged travel, live entertainment and physical retail that companies across those industries have frozen their marketing, causing ad prices to plunge.

Meanwhile, online beauty brand Insert Name Here is generating so much business that it's snapping up ad space at a discount.

Based in Los Angeles, Insert Name Here sells hair extensions and wigs, which are in high demand now that women are unable to visit their hairstylists. To reach all those consumers who are stuck at home, Insert Name Here is working with social media influencers to create do-it-yourself styling videos for Instagram as well as Facebook, Tik Tok, Snapchat and YouTube.

Kevin Gould, Insert Name Here's co-founder, said prices for digital ads are currently down by about 35%, and the company has bolstered its spending, which is in the millions of dollars a year, by about 50% to 100%.

Gould said it's important to be sensitive to the challenges consumers are experiencing and that influencers are the most effective way to reach them.

"People want content that's relevant to what they're going through," said Gould, whose investment firm and talent agency firm Kombo Ventures owns stakes in Insert Name Here and beauty brands Wakeheart and Glamnetic. "We spent a lot before, but we're spending more than we normally have, and I don't see that changing much over the course of the next couple months."

With millions of Americans ordered to stay home and unemployment spiking to historic rates, the top online ad companies, led by Google and Facebook, are suddenly stuck with too much inventory, forcing them to cut prices even as web traffic has climbed.

The big spenders are bailing. Expedia Group Chairman Barry Diller told CNBC's Squawk Box on Thursday that the online travel agency will likely slash ad spending by at least 80% this year to under $1 billion. Airbnb said in late March that it's suspending marketing. Airlines and cruise companies are cutting costs across the board and have little reason to pay to promote their products and services.

Then there are companies in e-commerce, internet gaming, online education and remote work software that are seeing their products fly off the virtual shelves. With so many people glued to their computers, they have more eyeballs to reach than ever before, creating huge branding opportunities.

Media agency PMG says its clients, primarily in retail, are seeing about a 25% increase in traffic to their sites, with costs per click (CPC) for ads down as much as 41% from before the pandemic, said Nick Drabicky, vice president of client strategy. He said on average CPCs are down 10-15%.

Socialbakers, a social media marketing company, says that CPCs on Facebook plunged by more than half from December to the end of March, and analysts at Bernstein said last week that ad prices on Twitter have declined 20% to 40%.

'Ceased advertising'

Rick Heitzmann, a partner at venture firm FirstMark Capital, said ad rates are down 30% to 35% across much of his portfolio, depending on the sector.

"Whether it's Facebook or TV, as people are spending more time at home and more time in front of screens, they're generating a large amount of inventory, and at the same time large sections of the economy have ceased advertising," Heitzmann said. "The supply and demand curve has changed dramatically, and the clearing price is lower than it's been in six to eight years."

At Flowplay, which makes online casino games, CEO Derrick Morton began noticing two things happening concurrently in late February and early March, as the coronavirus started spreading rapidly across the country.

On one hand, existing gamers increased their session times by 25%, meaning more revenue from existing customers. Meanwhile, newcomers were increasingly searching Google for keywords like "free games" and "online games," providng an opportunity for Flowplay to grab new users.

Prices for those keywords have only dropped by about 10%, less than in other areas, Morton said, because a lot of companies are still bidding for them. To reach those users, "we're spending 35% over what we had originally budgeted because the opportunity was there, and we'll probably do at least that in April," he said.

Flowplay doesn't do much social advertising for its core games, Vegas World and Casino World, but Morton said the company is developing a new title for next month specifically targeted at people who are now spending time live streaming. The game is designed to be social, allowing people to play poker and Yahtzee together. Morton said he expects to spend hundreds of thousand of dollars promoting it on places like Facebook and Twitter.

"More customers are looking for things to do online, particularly games," Morton said.

AdColony, which helps app developers grow their audiences and works with marketers to advertise in the mobile space, ran a survey in March and found that two-thirds of respondents were playing more games than before the pandemic began, said Matt Barash, senior vice president of strategy and business development.

"There's definitely an uptick for performance marketers who are looking to aggressively capitalize or capture the moment when users are searching for new titles," Barash said.

Still, advertisers have to be cautious and keep their messaging from sounding tone-deaf amid a global health and economic crisis. They also have to determine whether the pop they're seeing is temporary or if it's likely to last when society begins to reopen.

Kathleen Petersen of digital marketing agency Nina Hale said it's a good time for brands to focus on driving awareness and to create a relationship with consumers, rather than working on the hard sell.

"People are apprehensive," she said. "They're not sure if they're going to have their jobs, they're scared to spend money the way they normally would."

Boon in online learning

MasterClass, a subscription service with online classes for cooking, music, photography and many other subjects, is boosting its ad spending to meet demand from new users, said David Schriber, the company's chief marketing officer.

Historically more popular on smartphones, MasterClass started noticing that people were accessing the app from Roku devices, Amazon Fire TVs and other big screens as they removed their headphones and watched alongside family members.

"We saw the shift in behavior right away," said Schriber, who's based in Los Angeles but is now working from his home in Portland, Oregon.

The company's ads are showing up on Facebook as well as on TV networks like ESPN, CNN and Discovery, which are all taking a hit from the decline in advertising. Magna Global predicts national TV ad revenue will drop 13% this year.

Former FBI hostage negotiator Chris Voss's MasterClass on tactical empathy has become the most-watched program, Schriber said. Viewers have also been flocking to designer Kelly Wearstler's course on interior decorating, Neil deGrasse Tyson's class on scientific thinking and Paul Krugman's on economics and society.

Annual memberships run $180. During the crisis, the company has been promoting offers that let subscribers buy one and give one to a friend or someone else for free.

Schriber said the company doesn't disclose growth numbers and he didn't say how far ad prices have fallen, but he said the biggest declines have been on the TV side. Because the company's 200-plus employees are sheltered in place, MasterClass isn't able to shoot new videos for commercials and is instead using snippets of existing classes to create new ads.

"It's a different way of getting the job done," Schriber said. "We won't go out and film until we're compliant locally and until we feel comfortable gathering in groups."

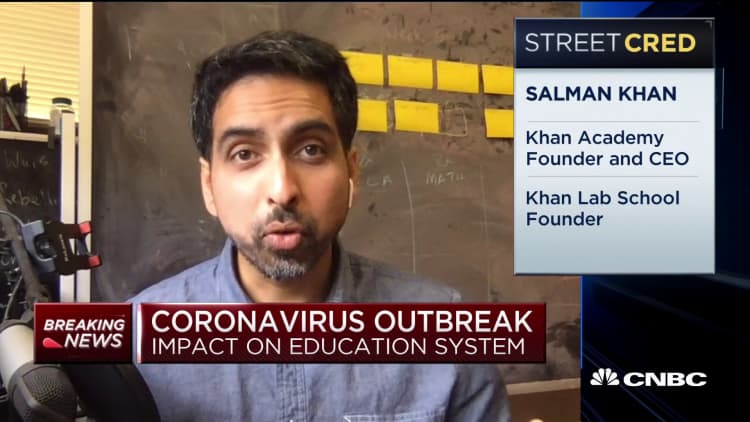

WATCH: Khan Academy CEO on how his company is educating children due to surge in remote education